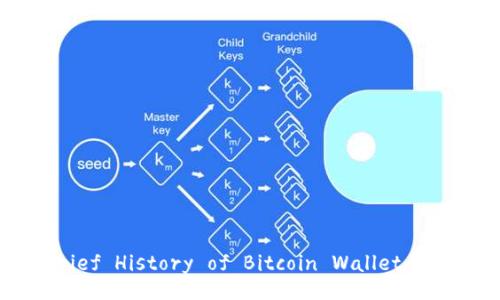

The rise of Bitcoin in 2009 marked the beginning of a new era in digital finance, allowing users to engage in peer-to-peer transactions without the need for intermediaries such as banks. At the core of this revolution was the Bitcoin wallet, which serves as a digital interface for managing cryptocurrencies. The development of Bitcoin wallets has evolved rapidly since then, adapting to various needs and technological advancements. This article explores the history of Bitcoin wallet development, the types of wallets that have emerged, their security features, and much more.

### Early Days of Bitcoin WalletsInitially, Bitcoin wallets were straightforward and lacked many features we see today. The first Bitcoin wallet, known as Bitcoin-Qt, was released in 2009. This wallet was essentially a full node, meaning it required the entire Bitcoin blockchain to function, consuming significant storage and computational power. Users needed to download the entire blockchain—over 200 GB as of 2023—to use the wallet effectively. This limited accessibility for the average user, as not everyone had the hardware or technical knowledge to set up a full node.

As Bitcoin gained popularity, the demand for more accessible wallets arose. This necessity led to the development of lightweight wallets that did not require downloading the entire blockchain. These wallets, known as Simplified Payment Verification (SPV) wallets, rely on full nodes to verify transactions. They allow users to carry out transactions with lower resource requirements.

### The First Generation of WalletsBy 2011, several third-party wallets began to emerge, marking the advent of hosted wallets, which provide user convenience at the cost of control over private keys. Platforms such as Blockchain.info (now known as Blockchain.com) and Coinbase entered the market, allowing users to create wallets more easily and securely. These wallets provided features such as ease of use, backup options, and online access, making Bitcoin more user-friendly for beginners.

However, with the rise of hosted wallets came security concerns, as users had to trust these platforms with their private keys. This sparked discussions about whether individuals should control their own keys or if third-party services were a better alternative. Wallet security became a hot topic as hackers targeted exchanges and wallet providers, leading to significant losses for users.

### The Emergence of Hardware WalletsIn response to security concerns, hardware wallets began to emerge in 2013. Devices like Trezor and Ledger provided an offline solution for storing Bitcoin securely. These hardware wallets generate and store private keys outside of a user’s computer, minimizing the risk of online hacks. For the first time, users could securely manage their cryptocurrencies while maintaining control over their private keys.

Hardware wallets quickly became popular among serious investors and traders due to their ability to provide heightened security measures. As trust in digital assets grew, more users began to invest significant amounts of money in Bitcoin. Hardware wallets offered peace of mind, enabling users to store their assets offline while still being able to access them when needed. The convenience of being able to securely store multiple cryptocurrencies on a single device further contributed to their popularity.

### The Rise of Mobile WalletsWith the advent of smartphones, mobile wallets emerged around 2014, allowing users to manage their Bitcoin holdings on the go. Wallet apps like Mycelium and Coinomi provided functionalities for sending and receiving Bitcoin from mobile devices. This evolution shifted how people interacted with Bitcoin, making it easier to use for everyday transactions.

Mobile wallets also offered unique features such as QR code scanning, allowing users to quickly send or receive payments by simply scanning a code. This level of convenience was especially appealing in retail environments, where speed and efficiency are crucial. Moreover, many mobile wallets integrated features like exchange services, enabling users to convert their Bitcoin to other cryptocurrencies seamlessly.

### The Current State of Bitcoin WalletsToday, the landscape of Bitcoin wallets is diverse and continually evolving. Users have access to a variety of wallets, including desktop wallets, mobile wallets, hardware wallets, and web wallets. Each type offers distinct features suited for different user needs. The emphasis on user experience has led developers to prioritize accessibility, security, and additional functionalities such as built-in exchanges and wallet recovery options.

Additionally, security measures have improved significantly. Many wallets offer features such as multisignature transactions, two-factor authentication (2FA), and biometric security to enhance user protection. These advancements have made Bitcoin more secure and appealing for both casual and professional investors alike.

--- ### Common Questions About Bitcoin Wallets ####Bitcoin wallets come in several types, each catering to different user needs and preferences. The primary categories include:

- **Desktop Wallets**: These are software applications installed on a user's computer. They provide a balance between usability and security but can be susceptible to malware attacks. - **Mobile Wallets**: Designed for smartphones, mobile wallets allow users to manage their Bitcoin on the go. They are particularly useful for everyday transactions and often include features like QR code scanning. - **Web Wallets**: These are hosted wallets accessible through web browsers. They offer convenience but require users to trust a third-party service for their private keys. - **Hardware Wallets**: Physical devices designed to store private keys offline. They are considered one of the most secure options for long-term storage. - **Paper Wallets**: These are physical documents containing a user’s public and private keys. They are secure if generated and stored correctly but can be easily lost or damaged.Each wallet type has its advantages and disadvantages, and users should select one based on their needs for security, convenience, and compatibility with their activities in the cryptocurrency space.

####

Securing a Bitcoin wallet is crucial to protecting your assets. Here are several strategies to enhance wallet security:

- **Use Strong Passwords**: Create complex and unique passwords for your wallet accounts. Avoid using easily guessed information such as birthdays or common phrases. - **Enable Two-Factor Authentication (2FA)**: Adding 2FA provides an additional layer of security that requires not only a password but also a second form of verification, typically through a mobile device. - **Consider Hardware Wallets**: For those with significant amounts of Bitcoin, using a hardware wallet is advisable. These devices store private keys offline, minimizing exposure to online vulnerabilities. - **Regular Backups**: Consistently back up your wallet data and store it in a secure location. This ensures that you can recover your funds in case of device failure or loss. - **Be Wary of Phishing Scams**: Always verify website URLs and email addresses before entering sensitive information. Be cautious with unsolicited communications regarding your wallet.By implementing these strategies, you can significantly reduce the risk of losing your Bitcoin holdings due to theft or mishandling.

####Lost access to a Bitcoin wallet can be a highly distressing situation. Depending on the type of wallet used, recovery options may vary:

- **Recovery Phrase**: Most wallets provide a recovery seed phrase during the setup process. This sequence of words allows users to restore their wallets on compatible software. If you have this phrase stored securely, you can recover your funds. - **Backup Files**: For desktop wallets, users can create encrypted backup files to restore their wallets. If these backups are stored properly, they can facilitate recovery on a new device. - **Lost Private Keys**: If you lose your private keys without a recovery phrase or backup, you will likely lose access to your Bitcoin forever. This is a core principle of cryptocurrency security, emphasizing the importance of securing private keys diligently.To mitigate risks, always make sure to back up your wallets and keep recovery phrases in secure locations. Regularly revisiting backup procedures ensures seamless recovery options in case of loss.

####

Selecting the best Bitcoin wallet requires considering several factors, including:

- **Security**: Determine how you prioritize security versus convenience. If you hold large quantities of Bitcoin, investing in a hardware wallet for offline storage may be essential. - **Usage**: Consider how frequently you plan to use Bitcoin. For regular transactions, mobile or web wallets may be more suitable. For long-term storage, opt for desktop or hardware wallets. - **Features**: Look for wallets that offer additional functionalities, such as integrated exchanges, multi-currency support, or usability features like transaction history and analytics. - **User Experience**: A user-friendly interface is crucial, especially for beginners. Test various wallets to find one that feels comfortable and easy to navigate. - **Reputation**: Research the reputation of wallet providers, especially for web wallets. User reviews and security history can provide insights into reliability and performance.By evaluating these factors, you can select a wallet that aligns with your cryptocurrency needs and security expectations.

####The future of Bitcoin wallet development is poised for dynamic changes as technology and user needs evolve. Several trends are likely to shape the landscape:

- **Enhanced Security Features**: As hacking techniques become more advanced, wallet developers will prioritize security enhancements. We can expect more wallets to adopt biometric security, hardware encryption, and multisig functionalities. - **Integration with DeFi**: The rise of decentralized finance (DeFi) is likely to influence wallet features, especially those offering integrated trading, lending, and borrowing functionalities. - **Improved User Interfaces**: User experience (UX) will continue to be a focus as developers seek to make wallets more intuitive and friendly for newcomers. Improved onboarding processes and customer support options may emerge. - **Multi-Asset Support**: As adoption of cryptocurrencies grows, we can anticipate more wallets supporting various blockchain assets, not just Bitcoin. This feature may appeal to users wishing to manage diverse portfolios with fewer applications. - **Interoperability**: Future wallets might focus on enabling seamless transactions across multiple blockchains, enhancing efficiency in cross-chain trading.The world of Bitcoin wallets is continually evolving, reflecting the growth of cryptocurrency and the increasing demand for efficient, secure, and user-friendly solutions. Keeping abreast of these trends will be crucial for users seeking to navigate the crypto landscape confidently.

--- In conclusion, understanding the history and evolution of Bitcoin wallets provides valuable insights into how we interact with cryptocurrencies today. As technology continues to advance, so too will the solutions available for securing and managing digital assets, empowering users around the globe.

leave a reply